- Transformation at the Forefront

-

In the last four years, we have seen significant improvements across many key areas within the Bank. The Group and the leadership team has worked extremely hard to deliver the four-year strategic plans that were put in place, resulting in the solid foundation across key business parameters and corporate governance that we see today.

- Strong Corporate Governance

-

More than ever, good leadership is key to withstanding the major challenges of the banking landscape and delivering superior performance. Therefore, the Board remains committed to maintaining the highest standards of good governance. In FY2020, we continued to strengthen the Group’s corporate governance with a common set of expected behaviours developed over time. Our corporate values and effective governance systems have created a strong ethical and governance culture across the Group. The principles governing our ethical standards are entrenched within our internal policies, such as the Code of Conduct, Code of Ethics and the Whistleblower Protection Policy.

- Sustainable Banking

-

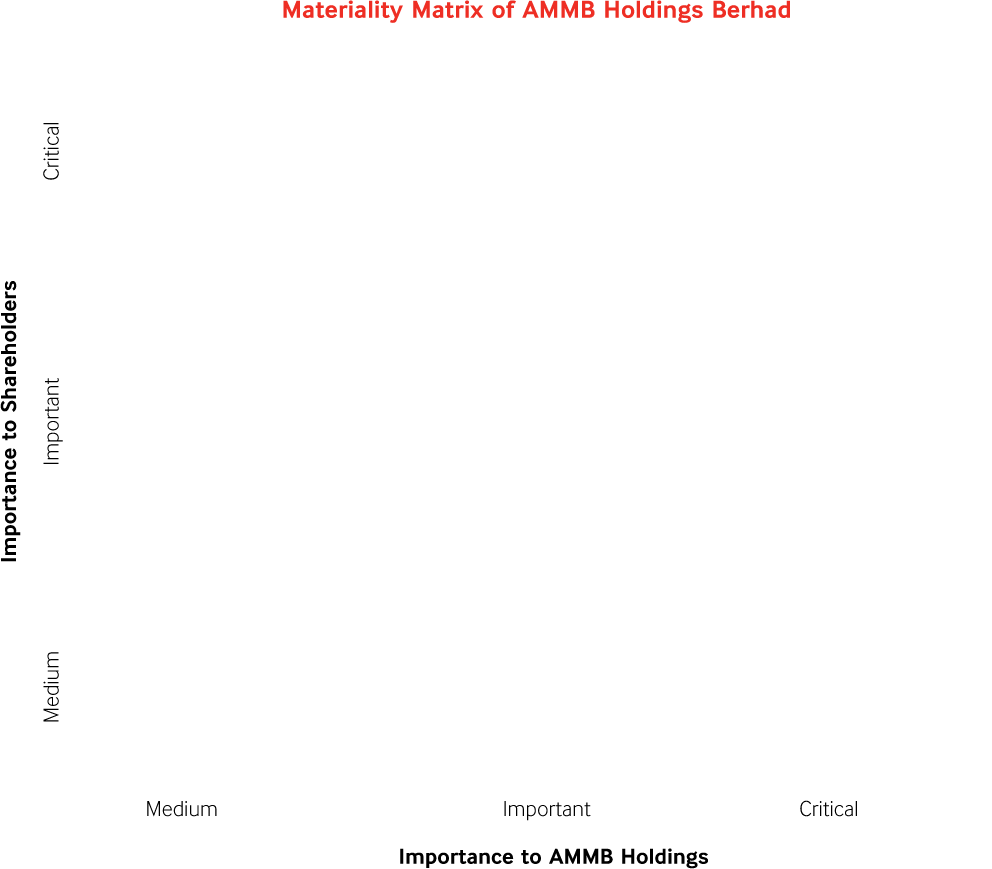

As a responsible bank, we are committed to balancing our profits with social and environmental well-being. The future growth of the company relies on our ability to mitigate Environmental, Social and Governance (ESG) risks. We developed the Group’s Sustainability Framework to outline the parameters of our journey towards becoming a sustainable bank. Through the implementation of this Framework, we integrate ESG and Value-Based Intermediation (VBI) considerations into our decision-making processes without compromising our financial objectives. The Framework aligns with the Group’s business priorities as well as key principles that contribute to positive social and environmental impact. The Sustainability Framework is governed by an enhanced sustainability governance structure consisting of new roles that are critical to effectively execute our sustainability strategies.

- People-Oriented Bank

-

We are a people-oriented bank – our work revolves around creating value for people and is simultaneously driven by people. Our business objectives rely on the capability and well-being of our workforce. In line with our transformation into the new era of banking, we are providing opportunities for employees to leverage their various skill-sets with the power of data and advanced analytics. Our efforts in retraining, reskilling and redeploying resources are a continuous process that aims to improve the optimisation, competency and timing of our operations whilst concurrently gearing our workforce for the future.

- Shareholder Value

-

The Board remains committed to enhancing shareholder value according to regulatory buffer and working capital requirements. We strive to ensure that our proposed dividend payout remains appropriate for the Group to continuously fulfil both our financial and prudential objectives.

For this financial year, we are pleased to declare a final dividend of 7.3 sen per share, bringing the total dividend to 13.3 sen. This year’s dividend payout ratio of 30% is a reflection of a more cautious outlook on the near-term economic conditions.

- Looking Ahead

-

In the upcoming year, we anticipate the economic effects of the COVID-19 pandemic onto the business climate. While Malaysian banks’ capital and liquidity are substantial enough to absorb losses in the current economic conditions, we are entering unchartered territory. It is difficult to fully predict where a shock is going to come from as there is limited visibility on how the shocks will transmit and evolve. We expect that the pandemic, compounded by domestic challenges, will contribute to a decline in overall loans growth. There are also several key areas that demand the banking sector’s attention beyond business continuity, namely credit management, supporting our customers, digitalising service offering, and cost management.

With the completion of AmBank Group’s Top 4 Strategy, we begin the next stage of our transformation journey. We will focus on building new areas of growth surrounding the Group’s renewed vision of Growing Trust, Connecting People. This will be our key theme moving forward, which reflects our strong belief in the legacy and solid relationships we have built over decades – servicing our customers for generations; cementing our trusted partnerships; and witnessing their growth from the beginning to where they are today.