AmInvest has declared income distribution for seven AmPRS funds under its Private Retirement Scheme (“PRS”) encompassing conventional and Shariah-compliant PRS offerings, across various asset classes. Total distribution was approximately RM12 million.

“We are pleased to deliver our valued and loyal investors with this income distribution. Despite the challenging and uncertain market environment last year, we applied the appropriate investment strategies to our fund portfolios to capitalise on the market volatility,” said Ms. Goh Wee Peng, Chief Executive Officer of AmInvest.

She added, “Our AmPRS fund offerings have been designed with long-term wealth creation in mind to help our investors in their bid to achieve their retirement financial goals and to eventually live their retirement dreams when the time comes. Our AmPRS funds provided income distribution yields between 3% and 13% per annum.1 The total returns of these funds including these income distributions reached a high of 33% for the year.1”

Over the last one year (as at 10 February 2021, ex-date for AmPRS funds’ income distribution), AmPRS–Islamic Equity Fund provided a total return of around 33% and declared a 10 sen income distribution for the year equivalent to a yield of 12%.1 AmPRS–Islamic Balanced Fund achieved a total return of 22% and gave out 6 sen income distribution equivalent to a 8% yield for the year.1 AmPRS–Conservative Fund gave out 8 sen income distribution, equivalent to an 13% yield for the year.1

Over the last five years (as at 10 February 2021), AmPRS–Islamic Equity Fund and AmPRS-Islamic Balanced Fund posted annualised total returns of around 11% and 9% respectively.1 In addition, AmPRS-Asia Pacific REITs, AmPRS-Dynamic# Sukuk and AmPRS–Conservative Fund have returned 5-year annualised returns of 6%, 5% and 5% per annum respectively over the same period.1

Ms. Goh reiterated that the performance of these funds is both a testament to and an affirmation of the fund managers’ expertise and investment capabilities garnered over the last four decades, as this year 2021 marks AmInvest’s 40th anniversary in the fund management business.

AmInvest has received various awards throughout the years for its expertise as well as capabilities in managing pension funds. Recently, it was named Malaysia’s Best Pension Fund Manager for the third consecutive year by Asia Asset Management at its Best of the Best Awards 2021.2 AmInvest has also been honoured with two PRS awards by Private Pension Administrator Malaysia, namely the Top Achiever for PRS Assets Under Management Growth and Top Achiever for PRS Member Growth as part of its Growing PRS Together 2019 – Recognising Excellence Awards.3

AmInvest offers one of the most diverse ranges of retirement solutions in the market for Malaysian investors to choose from according to their respective retirement needs, goals and risk tolerance. The fund management house is also the only PRS Provider in the country to offer conventional bond and Shariah-compliant sukuk fund offerings, i.e., AmPRS-Tactical Bond and AmPRS-Dynamic# Sukuk.4

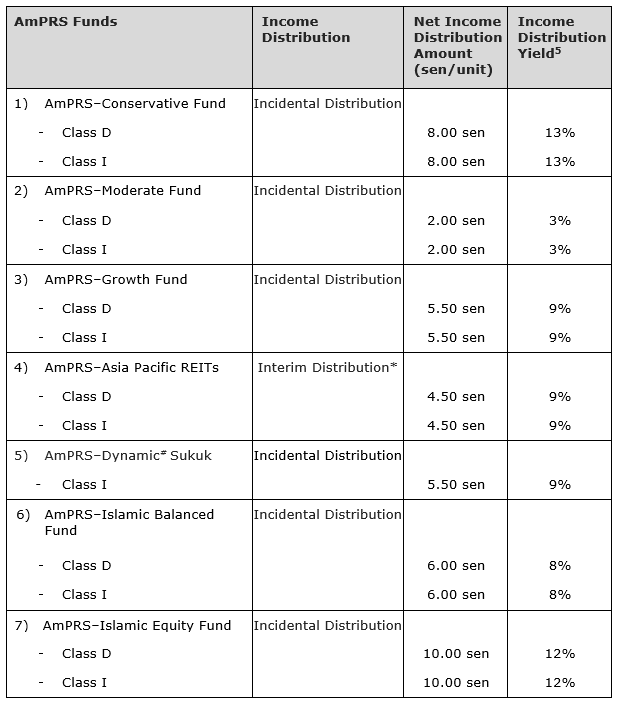

The net income distribution amounts declared for AmPRS funds are as follows:

*Subject to availability of income, distribution (if any) is paid at least once a year and will be reinvested. Note: Past performance is not indicative of future performance. Investments in funds involve risks including the risk of total capital loss and no income distribution. For more details on the risks of any particular fund, please refer to such fund’s Disclosure Document.

About AmInvest:

AmInvest is the brand name for the funds management business of AmFunds Management Berhad and AmIslamic Funds Management Sdn Bhd, both of which are wholly-owned subsidiaries of AmInvestment Bank Berhad. We are a multiple award-winning fund manager based in Malaysia with 40 years of investing experience managing unit trust funds, wholesale funds, institutional mandates, Exchange Traded Funds (ETF) and Private Retirement Scheme (PRS); encompassing both conventional and Shariah-compliant funds.

Sources & Notes:

#The word “Dynamic” refers to the Target Fund’s investment strategy which is active management, not a buy-and-hold strategy.

1 Based on performance data and income distribution yields for Class D compiled by Lipper, Refinitiv, as at 10 February 2021. Performance is shown in Malaysian Ringgit on a NAV price basis with income distribution reinvested. Performance figures are calculated net of all fees, charges and expenses, except entry charge and exit penalty (if any). Past performance is not indicative of future performance.

2 Awarded to AmInvest by Asia Asset Management at Best of the Best Awards from year 2019 to 2021.

3 Awarded to AmInvest by Private Pension Administrator Malaysia (PPA) at Growing PRS Together 2019 – Recognising Excellence Awards.

4 Based on data compiled by Lipper, Refinitiv under the Pension Funds category with a total of 57 funds (according to Lipper Global Classification), as at 10 February 2021 for the following funds: AmPRS-Tactical Bond (Bond Asia Pacific LC) and AmPRS–Dynamic# Sukuk (Bond MYR). Primary funds are to be used by default in performance statistics to prevent double counting and ranking anomalies.

5 Based on income distribution yields for Class D and Class I compiled by Lipper, Refinitiv, as at 10 February 2021. Performance is shown in Malaysian Ringgit on a NAV price basis with income distribution reinvested. Performance figures are calculated net of all fees, charges and expenses, except entry charge and exit penalty (if any). Past performance is not indicative of future performance.