American style

Gives the holder the right to exercise at any time from its issue date up to and including the Expiry Date.

At-the-money or ATM

- A call warrant is ATM when Underlying Instrument Price = Exercise Price

- A put warrant is ATM when Underlying Instrument Price = Exercise Price

Call Warrant

A warrant that gives the holder the right to buy the underlying share for an agreed price, on or before a specified date.

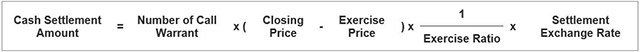

Cash Settlement Amount

If the cash-settled Call Warrant is In-the-Money, the Cash Settlement Amount upon exercise or expiry shall be:

If the cash-settled Put Warrant is In-the-Money, the Cash Settlement Amount upon exercise or expiry shall be:

Delta

Delta is the ratio of the change in the price of the warrant to the change in the price of the underlying.

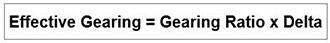

Effective Gearing

Effective Gearing is a measure of the actual leverage, which is computed as the theoretical % change in the call warrant price for a 1% change in the underlying Instrument price:

European Style

Gives the warrant holder the right to exercise only on Expiry Date.

Exercise Price

In the case of physically-settled warrants, the Exercise Price is the price at which the warrant holder is entitled to transact the underlying Instrument.

As for cash-settled warrants, the Exercise Price is the price that is used to calculate the Cash Settlement Amount.

Exercise Ratio

Number of warrants in exchange for one (1) underlying Instrument.

Expiry Date

The date on which the ability to exercise the call warrants expires.

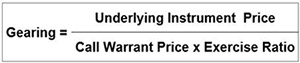

Gearing Ratio

Gearing ratio measures the exposure of warrants to the underlying Instrument:

In-the-money or ITM

- A call warrant is ITM when Underlying Instrument Price > Exercise Price

- A put warrant is ITM when Underlying Instrument Price < Exercise Price

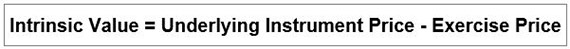

Intrinsic Value

Out-of-money or OTM

- A call warrant is OTM when Underlying Instrument Price < Exercise Price

- A put warrant is OTM when Underlying Instrument Price > Exercise Price

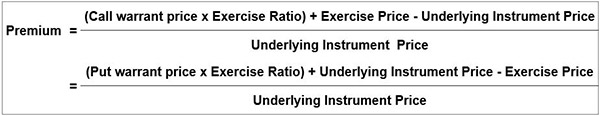

Premium

Premium measures the percentage over the underlying Instrument price required to break-even upon exercise or on expiry of the warrants:

Put Warrant

A warrant that gives the holder the right to sell the underlying share for an agreed price on or before a specified date.

Settlement Exchange Rate

The ratio of Settlement Currency to one unit of Reference Currency, being the currency of the underlying Instrument.

Advantages of Warrants

1. Leverage

Ability to invest in the movement of the underlying at a lower cost. The higher the gearing ratio, the higher the leverage.

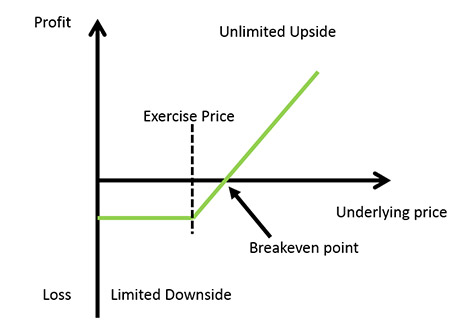

2. Unlimited Upside and Limited Downside

3. No margin call

4. Liquidity

Warrant issuers will ensure the liquidity of the warrant issues during the tenure of the warrants.

Characteristics of Warrants

The summary of the important factors affecting the pricing of the Structured Warrants is summarised in short as below:

| Change | Pricing Factors | Change in Call price | Change in Put price |

| Increase | Underlying Price | ||

| Increase | Excercise Price | ||

| Increase | Volatility | ||

| Decrease | Time to Maturity | ||

| Increase | Interest Rates | ||

| Decrease | Dividend |